Table Of Content

Home equity loans are essentially a second mortgage on your house, with fixed-rate monthly payments. You’ll pay back the loan at a fixed rate over a set term, such as 20 or 30 years. Because the debt is secured by your home, a home equity loan will typically come with a lower rate than unsecured options like a personal loan or credit card. Tying the loan to your home also comes with additional risk, as you could lose your home to foreclosure if you can’t keep up with your monthly payments. LMB Mortgage Services, Inc., (dba Quicken Loans), is not acting as a lender or broker.

Don't forget your loan-to-value ratio

That’s because the mortgage rate you’re offered will be influenced by your loan-to-value, or LTV – this is the size of the mortgage you need compared to the value of the property. Once you have paid off your mortgage entirely, and if you have no outstanding secured loans, then you’ll own 100% of the equity in your home. You could pay down your credit card balances to reduce your credit utilization rate. Also, avoid applying for any new forms of credit during the months leading up to a mortgage application. A HELOC behaves like a revolving line of credit, letting you tap your home’s value in the amount you need as you need it. A home equity loan works more like a conventional loan, with a lump-sum withdrawal that is paid back in installments.

What is a good credit score for buying a house?

A cash-out refinance refers to using your equity to get a new mortgage that's larger than the amount owed on your existing mortgage. Then, you pay off the existing mortgage and use the remaining money as needed. As with home equity loans and lines of credit, the funds are tax free because they're viewed as debt by the IRS, not income. You can withdraw money from your HELOC at any time during the draw period defined by your lender. HELOCs may have a minimum monthly payment due (similar to a credit card), or you may need to pay off the accrued interest each month. At the end of the draw period, you’ll need to repay the full amount you borrowed.

Home equity line of credit (HELOC)

College can be expensive, and student loans aren’t always the lowest-interest way to cover tuition and room and board. You can use your home equity to get cash for tuition or to consolidate your existing student loans into a single, lower-interest loan. For example, say you owe $100,000 on your home, and you believe your home is worth $180,000.

How We Make Money

However, it’s important to focus on improvements that actually increase the value of the home. For example, a kitchen update generally adds value to the home, but a swimming pool may be viewed by potential buyers as a safety risk and a maintenance headache. Unlike the other two alternatives, cash-out refinancing does not necessarily involve a second loan. In this case, you refinance your home for a larger amount, which allows you to take the difference in cash. You can have both a HELOC and a home equity loan at the same time, provided you have enough equity in your home, as well as the income and credit to get approved for both. There are a number of key benefits to home equity loans, including cost, but there are also drawbacks.

What should I look for when applying for a home equity loan?

If you have a conventional loan, PMI is automatically canceled once you reach 22% equity in your home, according to your regular payment schedule. However, you can request that your lender cancel PMI once you’ve reached 20% equity in your home. If you’re thinking about refinancing, it’s important to know that lenders usually require a home appraisal to determine the home’s value and the amount of equity you have. Estimating your home value can give you a rough idea of how much equity you have, but an appraisal is the only way to know for sure. The major difference between the HELOC and the standard home equity loan is that with the former type of mortgage, you call the shots and determine how much of the loan to use at one time.

Personal Loans vs. Home Equity Loans: Which Is Right For You? - Bankrate.com

Personal Loans vs. Home Equity Loans: Which Is Right For You?.

Posted: Tue, 12 Mar 2024 07:00:00 GMT [source]

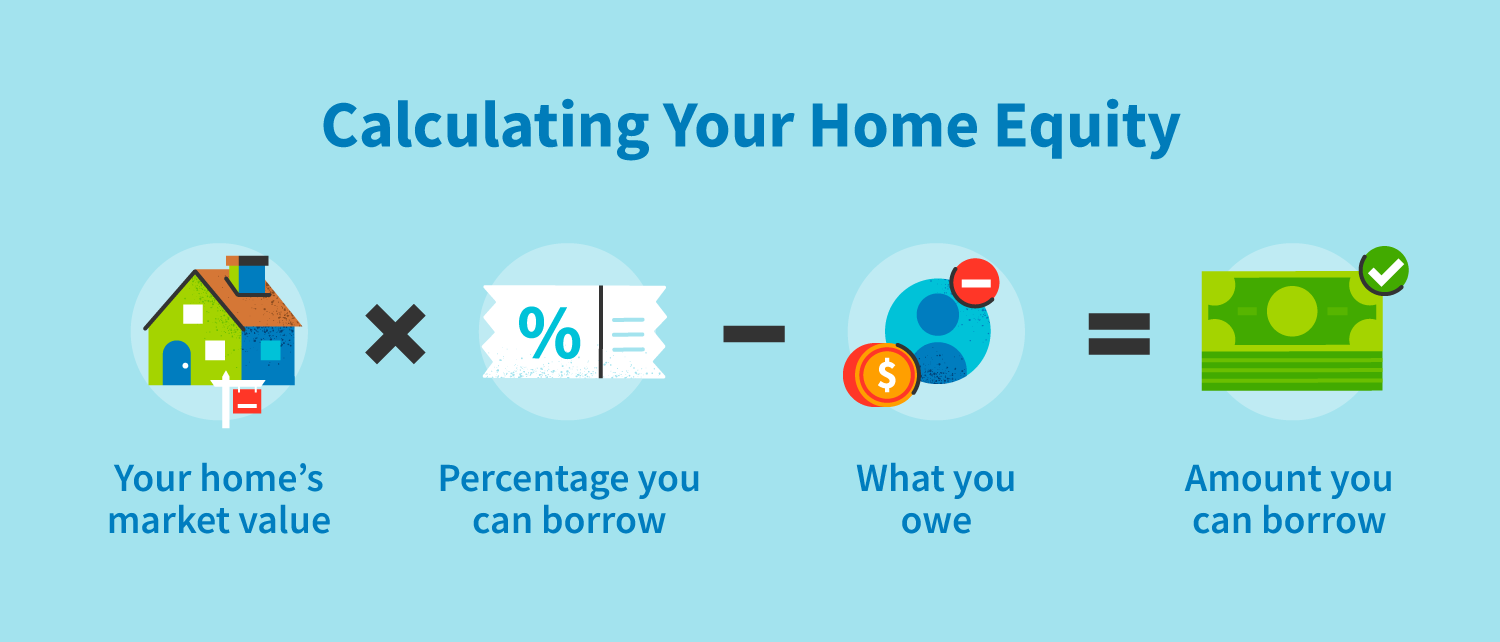

The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest. You can use your home equity as a way to help yourself with various financial situations and issues. This doesn’t mean you can just go to your bank and ask for $300,000. Depending on your credit history and other factors, the bank may let you borrow up to a certain percentage of it. Language barriers can impact officer safety, public safety, and the integrity of an investigation and prosecution. Negative equity means the value of your home is less than the amount you still owe on your mortgage, making it hard to remortgage or move house.

3 ways seniors should tap into their home equity, according to experts - CBS News

3 ways seniors should tap into their home equity, according to experts.

Posted: Thu, 21 Dec 2023 08:00:00 GMT [source]

Most importantly, you'll want to pay your bills on time each and every month. Your payment history is the factor that has the biggest influence on your credit score. Building a consistent history of on-time payments will always be a surefire way to improve your score. That's an interest variance of nearly 1.6 percentage points and a $327 difference in monthly payment from the 620 to 639 credit score range to the 760+ range. SB 9, dubbed the “duplex bill,” would offer homeowners new options to build additional housing on their lots, regardless of whether they’re currently zoned for single-family only.

How much home equity loan can I get?

Although you can get student loans to pay for higher education, a home equity loan could also be an affordable way to borrow for school, thanks to (usually) lower interest rates. Be aware, however, that a home equity loan doesn’t offer the same borrower protections as federal student loans, such as the ability to defer payments while in school. As you can see above, by the time you’ve reached the end of year 15, you will have built $58,457.55 in additional cumulative home equity just by paying your mortgage. This doesn’t include other equity you’ve built from your down payment, value appreciation, or sweat equity. The smartest strategy for accessing your home equity depends mostly on what you want to do with the money. Of course, your credit score and your financial situation matter, too.

If you have a poor credit score, you may only be able to borrow 50% of your home’s value, even though most lenders will allow up to 85%. Or, if you have a very high LTV, you may only be able to borrow 70% or 75%. A HELOC is a revolving line of credit that allows you to borrow against your home equity up to a specific limit. You can access the money on an as-needed basis, and interest only accrues on the amount you borrow. Because HELOCs are revolving lines of credit, you can continue to access the borrowing limit as you pay down your balance. Essentially, it’s how much of the home value you’ve already paid for, versus how much your mortgage lender is still financing.

You’ll typically have 10 years to draw from the line, and then a set amount of years to pay it back. When you purchase a home with a mortgage, ownership is shared between you and your lender. Your down payment represents your share of ownership in the home, while the lender owns the remaining stake.

No comments:

Post a Comment